Prime Minister Loan Scheme 2025

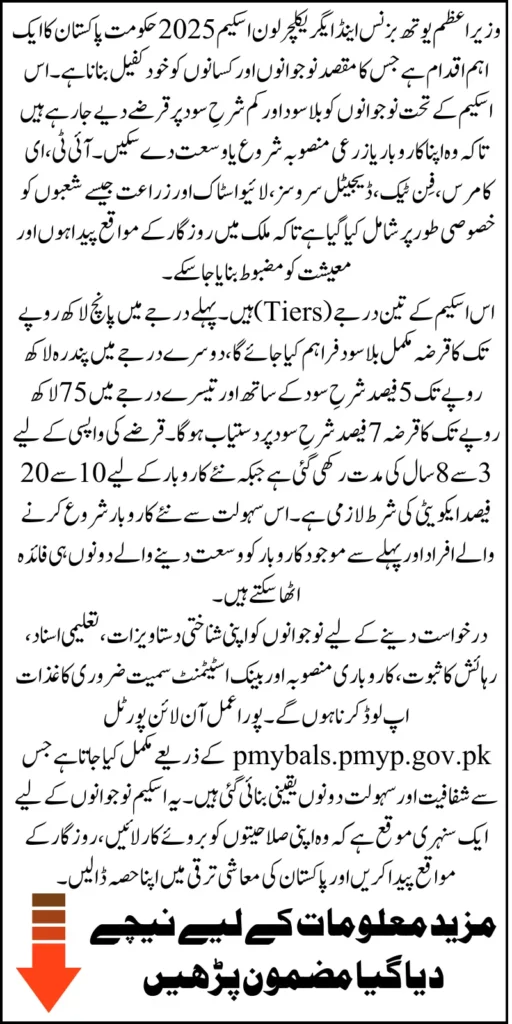

Prime Minister Loan Scheme 2025: The Prime Minister Youth Business and Agriculture Loan Scheme 2025 is a launched by the Government of Pakistan to empower young entrepreneurs and farmers. It aims to provide accessible, interest-free, and low-markup loans to help individuals start or expand businesses in key sectors such as IT, e-commerce, agriculture, fintech, and digital services. By offering financial support under easy terms, this program not only promotes self-employment but also contributes to economic growth and job creation.

This guide explains the complete process of applying for the loan, eligibility requirements, loan tiers, required documents, and tips to secure approval quickly.

Eligibility Criteria for PM Loan Scheme 2025

The scheme is designed for Pakistani citizens who meet specific requirements set by the government and State Bank of Pakistan. Applicants must fall within the eligible age bracket and present a feasible business or agricultural idea.

- Must be a Pakistani citizen with a valid CNIC.

- Must not be a loan defaulter of any bank

- Applicant must not be in criminal record

- Age Limit:

- 21 to 45 years for general businesses.

- 18 to 45 years for IT and e-commerce businesses (minimum matric education required).

- Eligible for new and existing businesses, including agriculture-based ventures such as livestock, crop production, and dairy.

- Can apply as an individual, partnership, or registered company.

These criteria ensure that only serious and capable applicants with the right potential can benefit from the scheme.

Loan Tiers and Key Features

The scheme offers loans in three different tiers. Each tier is designed to meet the needs of entrepreneurs at different stages of their business journey.

| Tier | Loan Amount | Markup (Interest Rate) | Repayment Period | Equity Requirement (New Businesses) |

|---|---|---|---|---|

| T1 | Up to PKR 500,000 | 0% (Interest-Free) | 3 Years | 10–20% |

| T2 | PKR 500,000 – 1,500,000 | 5% | 8 Years | 10–20% |

| T3 | PKR 1,500,000 – 7,500,000 | 7% | 8 Years | 10–20% |

Tier 1 is best for startups and small-scale businesses requiring limited capital. Tier 2 and Tier 3 are ideal for medium and large businesses that require machinery, vehicles, or expansion capital.

Also Read: Benazir Hunarmand Program 2025: Free Skills Training, Monthly Stipend & Job Support for Youth

Required Documents for Loan Application

To apply successfully, applicants must prepare and upload the necessary documents. These documents are used to verify identity, business plans, and financial eligibility.

- Copy of valid CNIC.

- Recent passport-sized photographs.

- Proof of residence (utility bills or government-issued documents).

- For IT/E-commerce applicants: proof of matriculation or higher education.

- Comprehensive business plan (including idea, market analysis, and financial projections).

- Bank statements of the last six months.

- Business registration certificate and tax documents (if applicable).

- Proof of agricultural land ownership or lease agreements (for farmers).

Submitting complete and accurate documents increases the chances of loan approval.

Step-by-Step Application Process

The registration process for the PM Youth Loan Scheme 2025 is entirely online, making it simple and transparent. Applicants can track their application status through the official portal.

- Visit the official portal: pmybals.pmyp.gov.pk

- Select “Apply for Loan” option.

- Enter CNIC number and date of issue.

- Choose your desired loan tier (T1, T2, or T3).

- Fill in personal details such as education, income, and contact information.

- Provide complete business details, including name, sector, and description.

- Upload required documents.

- Select loan amount and repayment period.

- Submit application online.

Once submitted, applicants can use the “Track Application” feature to stay updated on their application’s progress.

Also Read: BISP 8171 Portal Reopen Date Check Payment Using CNIC Know Full Guide Step By Step

Loan Utilization and Benefits

The loan can be used across multiple sectors, offering flexibility to entrepreneurs. This ensures that businesses get the resources they need to grow and succeed.

- Purchase of IT hardware and digital equipment.

- Buying agricultural machinery, tools, or livestock.

- Meeting working capital requirements.

- Acquiring vehicles required for business operations.

- Expansion of existing businesses with modern technology.

By utilizing the loan effectively, applicants can scale their businesses, generate jobs, and contribute to the economy.

Also Read: Get 3000 Monthly Relief Through CM Punjab Ration Card 2025 Guide Step By Step

Tips to Secure Loan Approval Quickly

Getting approval depends not only on eligibility but also on how well the application is presented. A strong application increases trust and reduces delays.

- Prepare a clear and realistic business plan with financial projections.

- Ensure all documents are scanned properly and valid.

- Mention previous business experience (if any).

- Show commitment to repayment by maintaining a clean financial history.

- Apply for the loan tier that realistically matches your business size and need.

These practices improve the chances of approval and help build trust with the lending bank.

Also Read: 8171 Ehsaas Program Check CNIC Online Web Portal – Step by Step Process 2025

Conclusion

The Prime Minister Loan Scheme 2025 is a golden opportunity for Pakistan’s youth to become self-reliant by starting or expanding their businesses. With interest-free loans for small ventures and low-markup loans for larger businesses, the scheme covers every segment of entrepreneurs.

By meeting the eligibility requirements, preparing the required documents, and following the step-by-step process carefully, applicants can secure approval smoothly. This initiative not only supports individual growth but also strengthens the national economy by promoting innovation, agriculture, and digital transformation.

Also Read: CM Punjab Flood Relief Program 2025 Complete Details Of 10 Lakh Aid To Support Affected Families

FAQs

What is the Prime Minister Loan Scheme 2025?

It is a government program that provides interest-free and low-markup loans to youth for starting or expanding businesses in various sectors

Who can apply for this loan?

Pakistani citizens aged 21–45, and 18–45 for IT/e-commerce with matric education, can apply if they have a viable business idea.

How much loan can an applicant get?

Loans range from PKR 500,000 to 7,500,000 depending on the selected tier.

What documents are required?

Applicants need CNIC, photographs, proof of residence, educational certificates, business plan, and bank statements.

How can someone apply for this scheme?

Applications can be submitted online at the official portal pmybals.pmyp.gov.pk by filling the form and uploading documents.